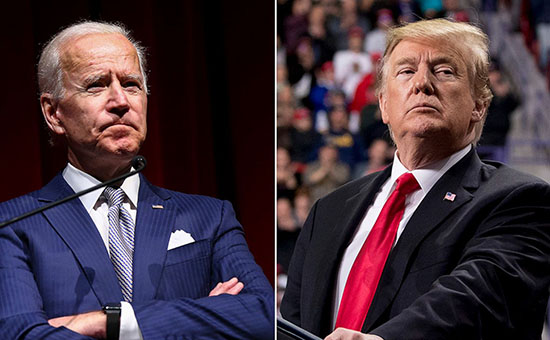

On Monday, local time, US President Trump stated in a speech that the Democrats were delaying a new round of stimulus measures in order to prevent Trump from being re-elected. He also directly called Biden a "stupid person."

September 8th. On Monday, local time, US President Trump stated in a speech that the Democratic Party was delaying a new round of stimulus measures in order to prevent Trump from being re-elected. He also directly called Biden a "stupid person." However, in a recent poll, Biden still has a significant advantage.

On Tuesday (September 8), silver futures opened at 27.040 US dollars per ounce, the highest reached 27.385 US dollars per ounce, the lowest touched 26.820 US dollars per ounce, as of press time, temporarily reported 26.900 US dollars per ounce, an increase of 0.70%.

Poll: Biden has a 71.1% chance of winning

On Monday, local time, US President Trump said in a speech that the United States is bypassing the last corner of the new crown pneumonia epidemic and expects that the country's economy will rebound next year. In his speech, he certainly did not forget to criticize Biden, his opponent in the election. Trump said that Biden and his very free running partner, Harris is the most liberal person in Congress, and in my opinion, he is not qualified for this. Work, they will destroy this country, destroy this country’s economy. Trump said: "Biden is a stupid person, you know."

In addition, regarding the delayed new round of stimulus measures, Trump said that Democrats in Congress do not want to reach a new round of economic stimulus packages because they think the stimulus measures will help him win re-election.

According to the polling analysis agency FiveThirtyEight's election prediction model on September 7, Joe Biden has a 71.1% probability of winning in the Electoral College election. He is expected to win 334 out of 538 electoral votes. The model predicts that Donald Trump has a 28.4% chance of winning.

Silver futures market outlook

As the dollar rebounded, precious metals have recently been restricted. Eugen Weinberg, head of commodity research at Commerzbank, pointed out that there are many factors in the entire market to digest, and the consolidation may last for a while, but it will not affect the long-term trend.

Daniel Pavilonis, senior market strategist at RJO Futures, pointed out that the risk of inflation makes him optimistic that precious metals will remain strong by the end of this year. In addition to inflation, he also believes that the US election in November may affect the trend of precious metals for the rest of the year. However, he believes that neither the general election nor the demand for hedging caused by geopolitical tensions will soon disappear.

Pavilonis also added that in addition to being bullish on gold, he is also bullish on silver, and even believes that compared with gold, it has greater potential. It is only a matter of time before silver follows the footsteps of gold and pushes to historical highs.

Judging from the 1-hour chart of silver futures, long and short momentum are extremely weak, and investors are waiting for more clear market signals.